3 Reasons to Use PoliceHomes

1. Seller Incentive program, we will sell your home for only 3% total commission, saving you 2% of your home's value

2. Buyer Incentive program, cash back to pay your loan closing costs (up to $2500 value)

3. For all home loans, we pay processing and origination fees and give you the lowest interest rate available on the day we lock your loan.

First let me introduce myself and what we do. My name is Brook Johnson, and I am the co-founder of PoliceHomes.com. I am a licensed California Real Estate Broker (Lic #01421164), and Mortgage Loan Originator (NMLS #879752)Licensed CPA (Lic# 88469) and a full-time police officer for the City of Los A

READ MOREFun Facts About PoliceHomes.com

We are passionate about helping our fellow officers achieve their real estate goals and dreams.

Happy Home Owners

Avg. Loan Closing Cost Savings

Avg. Home Purchase Savings

99% clients provide referrals

No Closing Cost Loan Options!

Here's the deal. When getting a home loan everyone charges you underwriting fees (about $900-$1000 on average), they charge you processing fees (another $600-800), and they charge origination fees... not us.

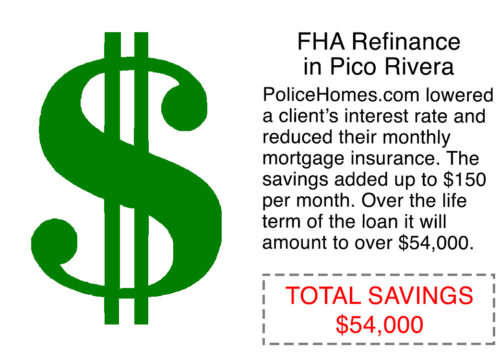

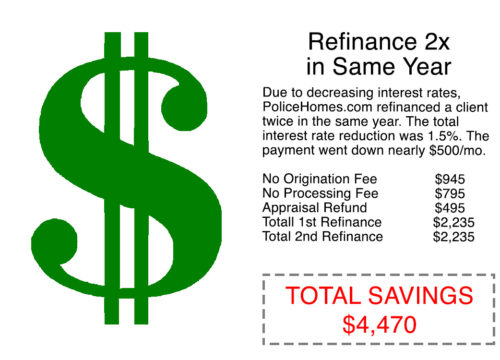

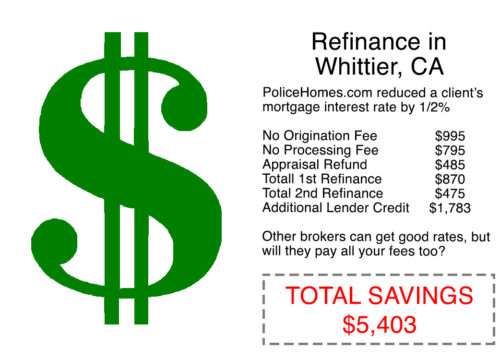

Mortgage Options Sell Your HomePoliceHomes.com Success Stories

In the last 5 years we have saved our clients approximately $375,000 in fees and commissions. Ask us how we can save you thousands on your real estate or mortgage transaction. Here are a few of the deals we've done for our clients. See the full portfolio of success stories.

What Clients Say

PoliceHomes truly lived up to their promises. I couldn't be happier with my new home and the mortgage.